Retirement can change dramatically at age 70!

It is very common for most of us to plan for the day we will retire. We will have

income from our pensions, savings, IRA, 401K, Social Security, etc. If we are aware

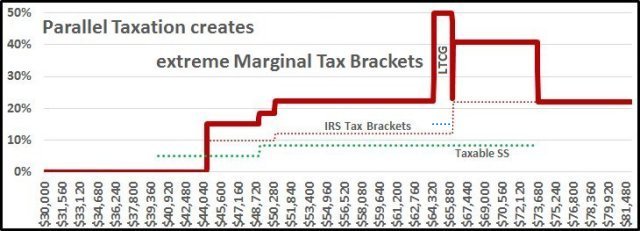

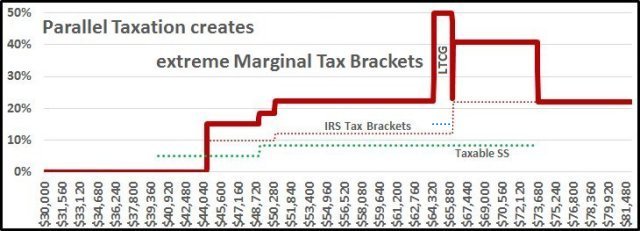

of our possible pending tax hump, we have also planned to balance our income sources

to avoid these potentially huge tax rates.

It is very common for most of us to plan for the day we will retire. We will have

income from our pensions, savings, IRA, 401K, Social Security, etc. If we are aware

of our possible pending tax hump, we have also planned to balance our income sources

to avoid these potentially huge tax rates.

Unfortunately, not all of us plan for the day that we turn 70. This is when the

government requires us to start making Minimum Required Distributions (MDRs) from

our IRA and 401K accounts. If we have locked in permanent income sources from Pensions,

Annuities, etc. this additional required distribution of taxable income can easily

push us into our personal Tax Humps.

The image on the left side of this page illustrates the increasing sizes of these MRDs

starting the year you turn 70 1/2. There are

distinct percentages of distribution for every age up to age 100. Each distribution

is a fraction of your total IRA value on December 31 of the previous year. Age 70

is 1/27.4, age 71 is 1/26.5, etc.

On average we generally save about $250,000 for retirement. The forced minimum withdraw

on that amount at age 70 will be $9,124 and $9,433 at age 71 and the amount will

continue to increase every year. If $9,000 of income is pushed into your personal

Tax Hump, your taxes will increase by $3,663, 40.7% and that does not include State

and Local taxes.

What can you do to plan ahead for this?

The primary defense against this is to reduce the size of your 401K/IRA. This does

not mean to save less for retirement! Save as much as you can while working, then,

just prior to retirement, properly move some of your 401K/IRA savings to other

retirement accounts that do not require MRDs.

Just be careful!

- There is a 10% penalty for making an early withdraw from our IRA before the

age of 59 ½

- Be careful of the size of your withdrawals and conversions after the age of 62.

- Your Medicare premium each year is based on your MAGI, Modified Adjusted

Gross Income, from your tax return 2 years prior.

- Your age 65 premium is based on your age 63 tax return! Age 66 premium

based on age 64 MAGI, etc.

- The 5-year rule for Roth IRA distributions stipulates that 5 years must have passed

since the tax year of your first Roth IRA contribution before you can withdraw the

earnings in the account tax-free.

|