Why did I create this website?

Iím a computer geek. I started building and programming computers for the US

Army in the 1960ís. After 4 years of active duty I used my computer related

background in 4 different civilian jobs. Then, at the age of 66, I was forced

into retirement by a physical injury. I had no idea of the tax implications

that I would be faced with during retirement and I made a number of financial

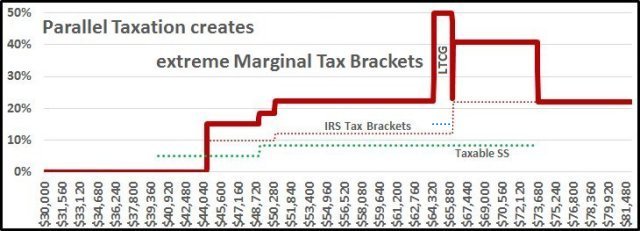

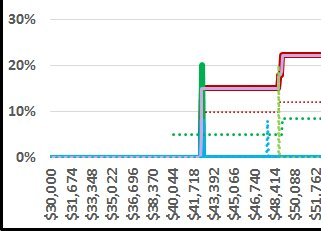

mistakes. Letting others know about what I call "The Marginal Tax Hump" caused

by the term I coined, "Parallel Taxation", is now my focus when Iím not

following my other retirement activities.

My last job offered a Long Term Disability plan where I paid the premiums and

they reimbursed me for the premium cost. Basically, I paid the taxes on the

premium payments, so when I was injured and forced into long term disability,

the payments that I received were "tax free". The insurance company basically

forced me to start my Social Security at age 66 and 6 months. According to

the plan as paid for, my payments from them were reduced by the size of the

Social Security benefits I would receive at that time.

To hide my personal information, for the sake of discussion let me offer some

numbers that are not accurate! Letís say that, in today's dollars, I was

earning $85,000 and my

plan paid me 60%, $51,000 a year tax free. My age 66 Social Security benefit

would be $30,000 so when my disability went from short term to long term they

reduced my payments from $51,000 to $21,000 plus the $30,000 from Social

Security.

Since we all live on After Tax income, not gross income, and when you consider the

deductions on each pay check for federal, state, and local taxes plus FICA

and Medicare plus contributions to the 401K plus health insurance, etc. getting

60% of your gross pay check is close to reality.

So, I was comfortably living for the next two year, the term of the policy,

on about the same income as before the disability. My mistake, since I had

no idea about "tax humps" of "parallel taxation", was to start my pension

and annuity payments.

If I had not started those income sources I could have taken money out of my

401K "tax free" or almost tax free. Instead of taking the money out, I could

have even transferred it from my 401K/IRA directly into my Roth account were

it could have grown tax free until I needed it.

At age 66 with a $30,000 Social

Security benefit I could have taken $12,400 out of the IRA tax free. My

taxability basis would have been $30,000 / 2 equals $15,000 plus $12,400 equals

$27,400 which is $2,400 over the $25,000 limit causing $1,200 of my Social

Security benefits to become taxable income. My AGI would then be $12,400 plus

$1,200 equals $13,600 which is exactly the $12,000 standard deduction plus the

$1,600 extra deduction for age 65! My annual taxes would be $0. At age 66 with a $30,000 Social

Security benefit I could have taken $12,400 out of the IRA tax free. My

taxability basis would have been $30,000 / 2 equals $15,000 plus $12,400 equals

$27,400 which is $2,400 over the $25,000 limit causing $1,200 of my Social

Security benefits to become taxable income. My AGI would then be $12,400 plus

$1,200 equals $13,600 which is exactly the $12,000 standard deduction plus the

$1,600 extra deduction for age 65! My annual taxes would be $0.

Letís skip all the math, but I could also have increased my Roth Conversion

from $12,400 a year to $18,750 a year putting me at the top of the 10% federal

bracket with the 50% taxability of my benefits for that extra $6,350. My total

tax due for the $18,750 Conversion would have only been $953.

Letís say that my annuity was $10,000 a year. The plan that I have grows by

about 9% each year that you wait to start it. Delaying the start of the annuity

would have raised the annual payments from $10,000 to $11,881 every year for the

rest of my life! There would have been a similar, but at a lower rate, increase

in my yearly pension payments.

Again, not to give away real numbers, but my income was about 20% higher than

my domestic partnerís income. Applying what I have learned to my partnerís

retirement, my partnerís after tax guaranteed income during retirement will be

almost 20% higher than mine!

I want everyone to know about "parallel taxation" and the "marginal tax hump"

that it creates so they can take the steps, if necessary, if possible, to

avoid their personal tax hump!

|